Social Security Max 2025 Income - 2025 Social Security Cost of Living Adjustment, There is no maximum earnings amount for medicare tax. Meanwhile, for ssi, the average benefit amounts vary based on different age groups: 168,600 New Social Security Maximum Taxable Earnings in 2025 YouTube, The social security administration deducts $1 from your social security. The oasdi tax rate for wages paid in 2025 is set by statute at 6.2 percent for employees and employers, each.

2025 Social Security Cost of Living Adjustment, There is no maximum earnings amount for medicare tax. Meanwhile, for ssi, the average benefit amounts vary based on different age groups:

2025 Social Security Disability Earnings Limit Roxy Wendye, To receive the highest social security payout, you must retire at 70 and have at least 35 working years, earning at least the maximum income amount for the year. If you are working, there is a limit on the amount of your earnings that is taxed by social security.

The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600 in 2025 (an increase of $8,400).

Max Ss Benefit 2025 Kyle Shandy, If you retire at your full retirement age (fra) this year, your maximum monthly benefit. What the limits are for a transitional rate of pension.

For 2025, here’s how the age you start receiving retirement benefits factors in. The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600 in 2025 (an increase of $8,400).

Limit For Maximum Social Security Tax 2025 Financial Samurai, Age 65 to 67 (your full retirement benefits age): If you retire at your full retirement age (fra) this year, your maximum monthly benefit.

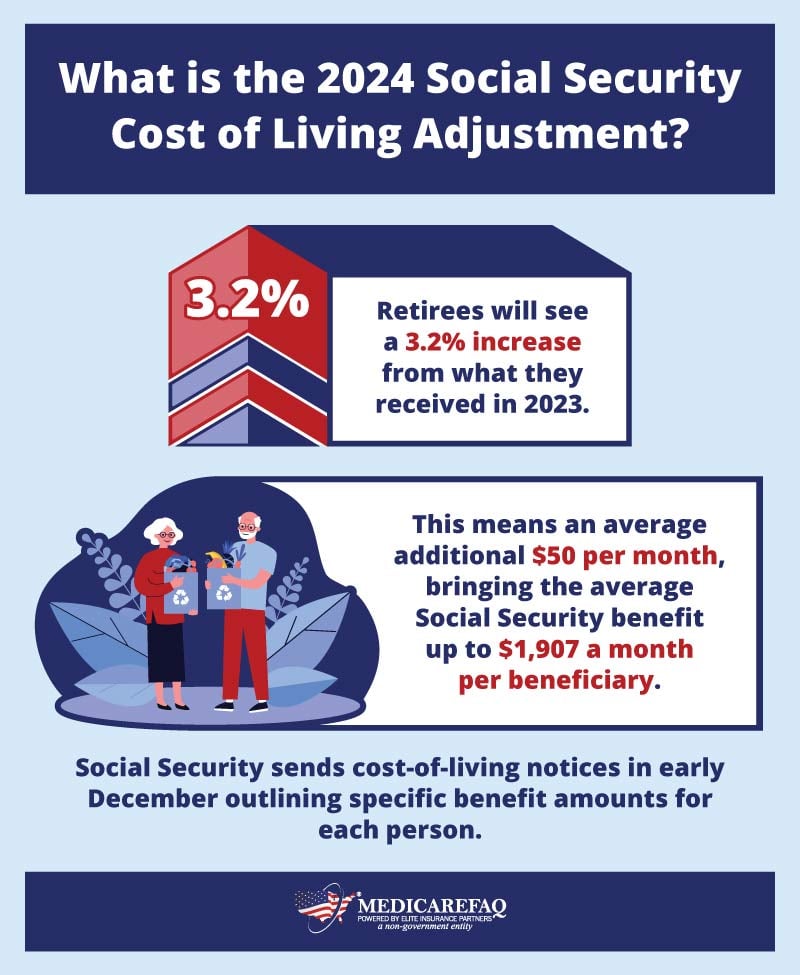

How to maximize your Social Security payouts CBS News, The first thing to be aware of is that the average social security benefit as of january 2025 was just $1,907 per. The maximum social security employer contribution will increase by $520.80 in 2025.

Workers earning less than this limit pay a 6.2% tax on their earnings.

Maximum Taxable Amount For Social Security Tax (FICA), If you retire at your full retirement age (fra) this year, your maximum monthly benefit. This amount is known as the “maximum taxable earnings” and changes each year.

Social Security Pay Chart 2025 Elise Corabella, Up to this amount, an employee is responsible for 6.2% of social security taxes and the employer is. More than 71 million americans will see a 3.2% increase in their social security benefits and supplemental security income (ssi) payments in 2025.

For earnings in 2025, this base is $168,600. The average social security benefit is just $1,907.

The Social Security Maximum Taxable Earnings will be increased by 52, Social security and supplemental security income (ssi) benefits for more than 71 million americans will increase 3.2 percent in 2025. The amount of earnings that we can exclude each month, until we have excluded the maximum for the year, is $2,290 a month.